Bridging the Gap

Until Your Next Paycheck

Sometimes, unexpected expenses can arise before your next paycheck, leaving you in a financial bind. These sudden costs can disrupt your budget and leave you struggling to make ends meet. That's where payday loans come in – they're designed to bridge the gap until your next payday, providing you with the cash you need to stay afloat during these challenging times.

Getting a loan

is easy!

Apply Online

Kick off the process with a simple online application, available 24/7 for your convenience.

We get straight to work

With our streamlined process, we can quickly determine your eligibility and loan terms.

Meet your lender

Discuss the final details, review the terms, and receive your funds in a timely manner.

How do I qualitfy for our

Payday Loan lender service?

To qualify for our payday loan lender service, we consider a few key factors to ensure a streamlined and transparent process. Our goal is to provide access to financial assistance for those facing temporary cash flow challenges. Here are the typical qualifications you'll need to meet:

Steady Employment or Verifiable Income Source

Minimum Age Requirement (typically 18 years or older)

Active Checking Account for Direct Deposit

Proof of Residence and Valid Government-Issued ID

Get a Quick Decsion

We understand that unexpected expenses can't be put on hold, which is why our streamlined application process and efficient review system are designed to provide you with a decision promptly. Once you've submitted your online application, our team works diligently to verify your information and assess your eligibility. Within a matter of hours, you'll receive a response, eliminating the stress and uncertainty of a prolonged waiting period.

With our commitment to swift decision-making, you can rest assured that your financial needs will be addressed promptly, allowing you to focus on resolving your pressing obligations without further complications.

500+

Satisfied Customers

5+

Years of Experiance

20+

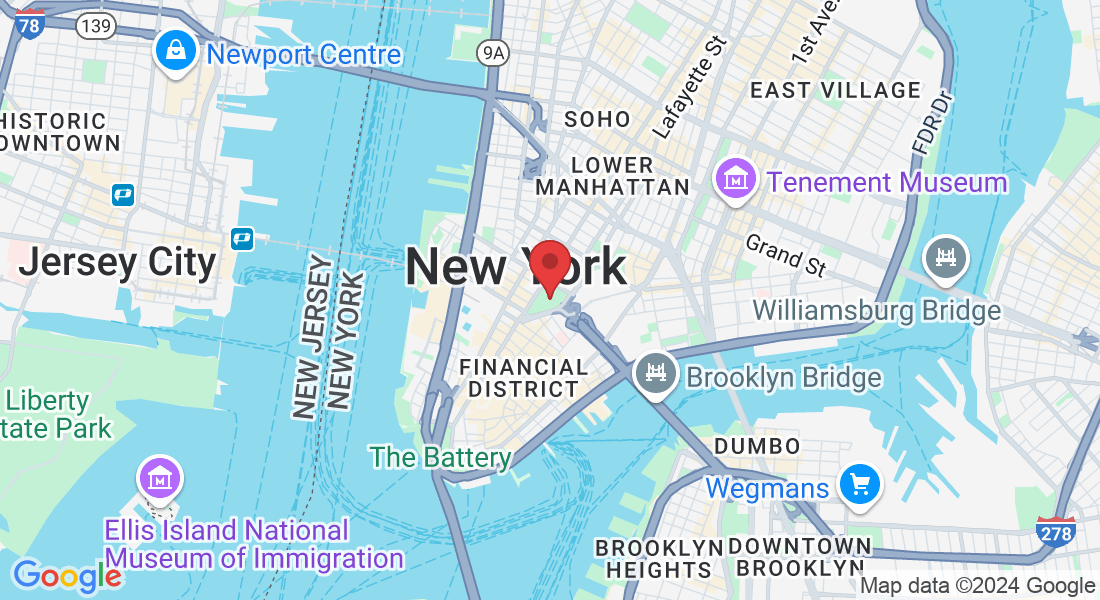

Cities Covered

5k

Staff Members

SERVICES LIST

What you will learn with this book

Short-Term Cash Loans

These loans provide a quick infusion of cash to cover immediate expenses until your next paycheck arrives. With relatively small loan amounts and short repayment periods, usually a few weeks, they offer a temporary solution for unexpected bills or cash shortfalls.

Payday Advances

Similar to short-term cash loans, payday advances are designed to bridge the gap between paydays. You can borrow a portion of your upcoming paycheck and repay the advance, plus fees and interest, when you receive your next paycheck.

Cash Loan

A cash advance allows you to borrow money against your credit card's available balance. Payday lenders may offer this service, providing you with immediate cash in exchange for fees and the promise to repay the advance from your next paycheck.

Title Loans (using a vehicle title as collateral)

For those who own a vehicle outright, title loans allow you to use your vehicle's title as collateral for a short-term loan. The lender holds onto your title until the loan, plus interest and fees, is repaid.

Installment Loans

Unlike single-payment payday loans, installment loans from payday lenders are repaid over a longer period through scheduled installments. This can make larger loan amounts more manageable but also increases the overall interest paid.

Check Cashing Services

Many payday lenders offer check cashing services, allowing you to cash personal, payroll, government, or other types of checks for a fee, providing instant access to those funds.

TESTIMONIALS

"Hawley's leadership is characterized by a unique blend of passion, drive, and an unwavering commitment to empowering others.

As a champion for women in the workplace, she has consistently demonstrated a profound dedication to fostering an inclusive and supportive environment. Her advocacy for female professionals not only uplifts the team but also inspires each member to reach their

full potential."

- Tracy Beckhusen

"Appreciation Financial welcomed me with open arms. Hawley guided me through the licensing process, introduced me to a one-on-one trainer, and spent time in the field with me. By sharing the AF System and business opportunity Hawley and the rest of the team showed me that my hard work would pay off! Hawley and the team have been so supportive and genuinely interested in my growth, and an integral part of my business success!"

- Erik Ong

Costs

Loan amount:

$xxx - $xx,xxx

Repayment period:

12 monts - 24 months

Payday loans typically come with relatively short repayment periods, often aligning with your next pay cycle. Many lenders require repayment in full, including the principal amount borrowed plus interest and fees, within 2-4 weeks. The interest rates charged by payday lenders are significantly higher than those offered by traditional banks and credit unions for longer-term loans.

Annual percentage rates (APRs) can range anywhere from 200% to 500% or even higher in some cases. While this makes payday loans an expensive option, the trade-off is quick access to cash for those unable to qualify for more favorable rates from banks. Lenders justify the higher rates as compensation for taking on borrowers with poor or no credit histories. It's crucial to carefully review the terms and have a plan to repay the full amount on time to avoid rolling over the debt and incurring additional fees.

FAQS

How much can I borrow with a payday loan?

The maximum loan amount varies by lender and state regulations, but typically ranges from $300 to $1,000. Many lenders offer smaller sums like $100 or $200 for first-time borrowers or those with limited income.

What do I need to qualify for a payday loan?

While requirements can vary, most lenders require you to be at least 18 years old, have a steady source of income, an active checking account, and a valid form of identification. Some may also consider your credit history but bad credit does not automatically disqualify you.

How long do I have to repay a payday loan?

Payday loans are short-term loans designed to be repaid with your next paycheck, usually within 2 to 4 weeks. Some lenders may offer slightly longer terms of up to 45 days, but the loan periods are meant to be brief until your next pay date.